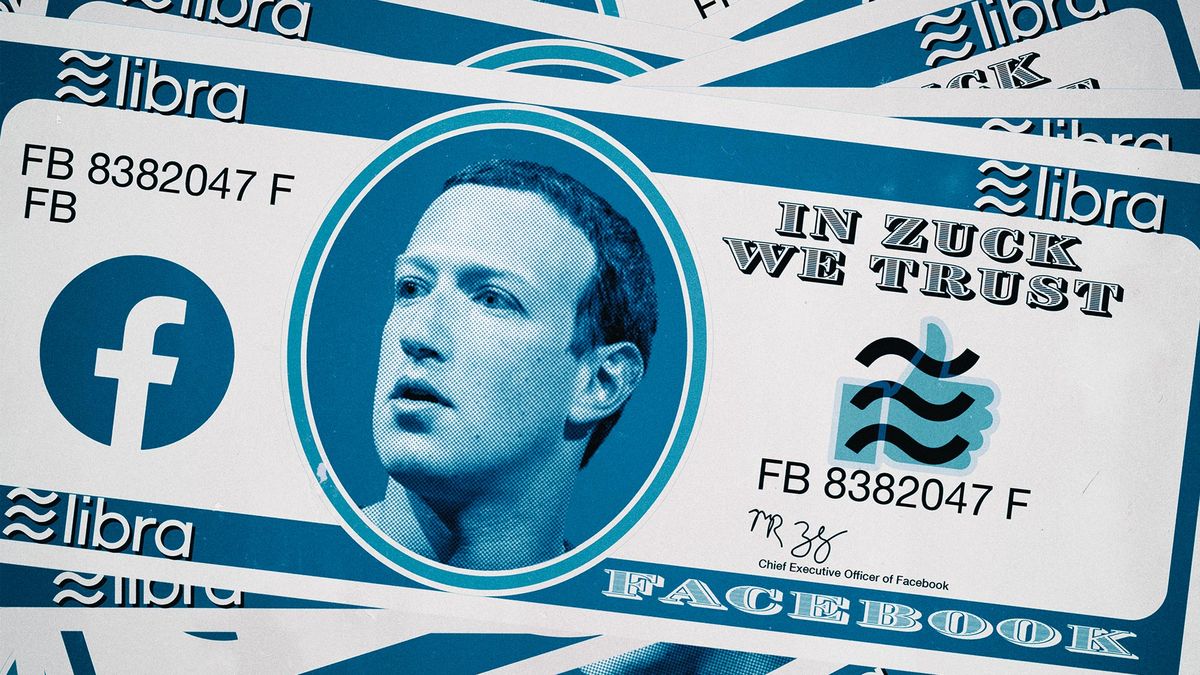

Facebook Inc. unveiled plans to launch Libra, a payment system it describes as “global currency” that’s based on blockchain, the same technology powering bitcoin and other cryptocurrencies. It’s backed by real assets and attached to stable government securities. I’ve heard that more than two dozen corporate partners are on board, including financial behemoths MasterCard, Visa, PayPal and Coinbase. With partners contributing membership fees of $10 million each, Facebook’s goal is to line up a total of 100 corporate partners and $1 billion in assets.

I recently had the pleasure of being guest on Breaking Banks – the #1 Global Fintech podcast. The host, my good friend Brett King, asked me what I thought about Facebook’s move, given the controversy engendered by its data scandal with Cambridge Analytica when it was revealed that CA had harvested the personal data of people’s Facebook profiles to use for political advertising purposes. Brett asked specifically if the network affect could triumph over privacy concerns.

First, I applaud Facebook for this move. It’s something the company has been teasing about for years and which it has to do to help its growth. However, it’s the platform that it has with billions of users that concerns me. Facebook is not synonymous with privacy, at least not in the several instances that have plagued it going back to the 2016 election. But Libra is bold, innovative and worth many incredible conversations. I think Facebook has some PR issues it has to work through, and I understand that it’s part of this huge network and ecosystem, but it’s platform is going to be a huge launching vehicle for Libra.

At the same time, I have to scold banks and finance brands for not actually getting there first. There was nothing to stop them, and something like Libra was inevitable. Banks could have done this! The problem is that banks got so caught up in iteration and not innovation, which is one of my big areas of research. It’s the difference between creating new services and value vs. building upon legacy services. Most banks still have a horrible mobile app yet here comes Facebook, a company no bank saw as a competitor for them, even though the company had been teasing for years. And now the banks are going to have to respond.

I’m looking at banks like Capital One that are focused on product management as a new discipline within the organization and are starting to build out more with a startup like expertise. That’s what banks need. Otherwise, they’re going to get stuck. I’ve heard of some banks that have a robot that greets you and helps you through your services. But if you’re walking into a branch, most likely you’re not going to be a customer of Libra. That’s what this is all about – reaching the “unbanked,” getting to the people who trust banks less than they trust Facebook!

I believe Facebook is actually helping rebuild trust and doing something about its tarnished image with its Libra announcement. To get out of that hot spot is a big deal. There are massive calls and demonstrations to remove Mark Zuckerberg as CEO but this movement is brilliant and scary at the same time. Facebook is its own closed ecosystem, it’s own internet, almost like a sovereign nation. So all of this reflects conversations of something akin to a sovereign currency. What is this going to do in terms of global currency?

We can’t know everything at the moment, but at the same time, I can’t emphasize enough that this is going to be a massive disruptor that is going to invite all kinds of competitors – the same way Apple Pay did when it came out – that will totally miss the mark as far as understanding the way human beings want to bank. There was a research study done a few years ago called “The Millennial Disruption Index” that asked, “Who do millennials see themselves banking with in the next ten years?” The top three responses were Google, Apple and Amazon, none of which are top tier banks. So Libra is huge in terms of possibility and disruption.

There will always be skeptics. In every circumstance of disruption, I have a common saying I throw out no matter the industry: ignorance and arrogance equals irrelevance. At the same time – and this goes back to the 30’s when Austrian economist Joseph Schumpeter coined the phrase “creative destruction” – closedmindedness stymies the opportunity to do great and inventive things. Banks and bankers often prefer their comfort zone, that paycheck, those bonuses every year. Banking is one of the worst offenders of iteration. And they’re getting what they deserve because Libra has the potential to reach 1.7 billion unbanked consumers. The Libra ecosystem is enormous, with some massive players to govern it. I wouldn’t be surprised if we will be watching some of our most recognized financial brands meet their demise in the next decade.

Image Credit: The Verge

Brian Solis, Author, Speaker, Futurist

Brian Solis is principal analyst and futurist at Altimeter, the digital analyst group at Prophet, Brian is a world renowned keynote speakerand 8x best-selling author. In his new book, Lifescale: How to live a more creative, productive and happy life, Brian tackles the struggles of living in a world rife with constant digital distractions. His model for “Lifescaling” helps readers overcome the unforeseen consequences of living a digital life to break away from diversions, focus on what’s important, spark newfound creativity and unlock new possibilities. His previous book, X: The Experience When Business Meets Design, explores the future of brand and customer engagement through experience design.

Please, invite him to speak at your next event or bring him in to your organization to inspire colleagues, executives and boards of directors.

Follow Brian Solis!

Twitter: @briansolis

Facebook: TheBrianSolis

LinkedIn: BrianSolis

Instagram: BrianSolis

Pinterest: BrianSolis

Youtube: BrianSolisTV

Newsletter: Please Subscribe

Speaking Inquiries: Contact

Leave a Reply