The Financial Brand featured Brian Solis’ predictions in its annual top 10 retail banking trends report for 2016.

By Jim Marous, Co-Publisher of The Financial Brand, Excerpt

For the fifth consecutive year, we have surveyed a panel of close to 100 global financial services leaders for their thoughts around upcoming retail banking and credit union trends and predictions. The crowdsource panel including bankers, credit union executives, industry analysts, advisors, authors and fintech followers from Asia, Africa, North America, South America, Europe, and Australia.

These exclusive interviews are one of the components of the expansive Digital Banking Report, ‘2016 Retail Banking Trends and Predictions’.

— Top 10 Retail Banking Trends and Predictions for 2016 —

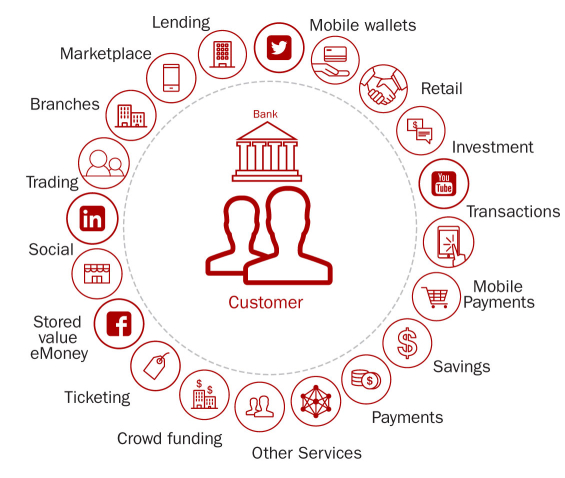

1. The ‘Platformification’ of Banking

2. Removing Friction from the Customer Journey

3. Making Big Data Actionable

4. Introduction of ‘Optichannel’ Delivery

5. Expansion of Digital Payments

6. Executing on Innovation

7. Exploring Advanced Technologies

8. Emergence of a New Breeds of Banks

9. Mining New Talent

10. Responding to Regulatory and Rate Changes

“In 2016, and over the years to come, retail banking will lean on UX (user experience) to design more than a ‘mobile first’ experience. Experience architects will rethink what a bank is and what it means to digital-first and mobile-only customers, designing an entirely new set of products that will lead to new types of relationships. It’s innovation and disruption over iteration. The ‘uber of banking’ is imminent.”

– Brian Solis, Principal Analyst for the Altimeter Group and author of the bestselling book, X: The Experience When Business Meets Design

I found some interesting titles but issue with your site. You need to take care of these silly mistakes. Overall nice blog but 2016 prediction for retail banking is looks like suggestions.