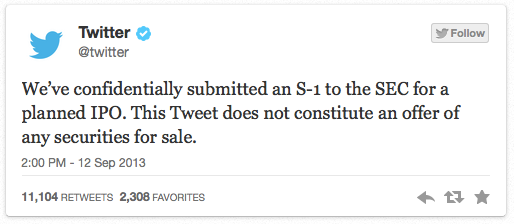

By now you’ve heard that Twitter IPO will fly soon. On the heels of its release of the controversial Conversations feature, Twitter announced, via a Tweet of course, a confidential S-1 filing for a planned IPO. In fact, just last week, I shared with ABC News that we needed to prepare for the inevitable. While many experts are jumping on their platforms to shout that it’s about time, many investors are smirking with clasped hands, understanding of course that in the game of ROI, this is in fact the right time. With over $1.16 billion in funding and an estimated market valuation at somewhere between $9 and $10 billion, Twitter’s patience and timing will serve amongst its greatest assets.

At Altimeter Group, each of the analysts cover Twitter in respect to each of our beats. In this case, I follow Twitter and study its impact on media, society and business. When it comes to an initial analysis of the meaning of Twitter’s IPO, my colleague and Altimeter Founder Charlene Li has us covered. Instead, I’d like to explore what this IPO means in the greater scheme of social media.

See, in addition to the role of an analyst, I’m also a user and stakeholder. I opened my @briansolis account in November of 2006. For me, like you, Twitter is personal. I wrote my first in-depth post about Twitter in March 2007 suggesting that the information network would be the “message heard around the world.” Since then, I’ve worked with or supported notable thought leaders around…

– #hashtags

– The first Twitter wall at conferences

– Early Twitter apps

– The Twitterverse

Now it seems that I’ll have an opportunity to move from stakeholder to shareholder and so will you.

Twitter isn’t Facebook nor is it YouTube or LinkedIn…meaning it’s not a traditional social network or social platform where its inherent benefit and worth is clear upon landing on its home page. It’s an information network that’s a unique blend of broadcast and conversation platform and therefore Wall St. will find it difficult to properly assess its value and growth potential. Let’s not forget that for its first few years of existence, one of the top Google auto-completes around Twitter was, “what is Twitter?”

All of this is enigmatic naturally…or “natch” as my good friend Kara Swisher would say. This is why Twitter hired Mike Gupta as its finance chief. In a recent article in the San Francisco Chronicle, Twitter investor and partner at Benchmark Capital Peter Fenton said of Gupta, “A lot of people are trying to understand, ‘How does this thing work? How does it make money?’ He has a layman’s ability to simplify and express it in a way that’s not overly complicated.”

Gupta will only help with relevance.

Twitter is complex to explain to say the least. While its unique technology and fervent userbase are significant, its Twitter role in society that has opened a new window to the world. Twitter is a human seismograph, recording details around culture, politics, trends, and anything else that people find Tweetable. Over the years, Twitter has blossomed into what I call TNN (Twitter News Network) where news no longer breaks, it Tweets. It’s index is powered by human experiences, observations and sentiment. It’s an extension of each one of us and equally a collective consciousness that informs, entertains, distracts, unites, and creates awareness.

As social media influencer John Rampton says, “This could be amazing for the company to be able to raise a little capital to help expand. I see nothing but big things for everyone using the product over the coming years.”

Twitter is the last of the big four to go public.

Yes, Twitter is the last of the four big social networks to hit the public market. But that’s an advantage. LinkedIn continually beats estimates and as a result, it stock is on the rise. I’ve always believed that Wall St. understood LinkedIn. I’d argue that many investors and traders managed a personal account and thus understood its value enough to sell it. That wasn’t the case when Facebook hit the market though. As we all know, Facebook’s IPO was marred by a series of setbacks that sent its stock into negative territory almost immediately.

When Facebook officially NASDAQ, its offer price was $38 a share and its valuation was about $100 billion. Facebook was resilient, righting to prove its value to the suits. While its work is far from done, its stock is now 60% north of its opening price following a diligent series of reinforcing and promising earnings calls. Just this week, the stock hit a new high. It doesn’t hurt Twitter that LinkedIn is also roughly 117% up from its opening price either.

So, thanks to Facebook and LinkedIn, Twitter will have a genuine shot at hitting the market on a positive note. Like Facebook, Twitter too is profitable. According to eMarketer, Twitter will bank $583 million in advertising revenue for 2013 and is expected to earn $1 billion in 2014.

Advertising is of course paramount to Twitter. Its promoted products are helping the company not only generate significant revenue, CEO Dick Costolo and co. have the burdensome task of also re-educating Madison Ave. on the future of advertising. The goood news is that under Costolo’s leadership, it’s working.

Like Facebook (that always makes me laugh when I write that), Twitter’s future is tethered to mobile engagement and advertising. On September 9th, Twitter acquired MoPub, a mobile ad exchange/publisher network, for $350 million in stock.

As for its share price and growth rate, we’ll have a chance to see when its S1 becomes public. In the mean time, we’ll wrap up on the words of Mark Zuckerberg. His advice to Costolo was shared on stage this week with Michael Arrington at TechCrunch Disrupt in San Francisco,”As long as they (Twitter) kind of focus on what they are doing, then I think it’s wonderful.” Zuckerberg also shared a personal lesson from Facebook’s IPO, “I’ve been very outspoken about staying private as long as possible … But in retrospect, I was too afraid of going public. I don’t think it’s necessary to do that.”

UPDATE: My quote to ABC News regarding whether or not going public equates to more ads…

As a public company, one of the voices, and arguably among the least qualified, that will drive Twitter’s business decisions is that of Wall St. Twitter has struck a unique balance between monetization and user experience. The question on the minds of experts, investors and users alike is whether or not going public will force Twitter to increase revenue by injecting more ads into the stream. The answer is yes. But I believe that Dick Costolo and company will continue to keep user experience at the forefront to protect the social chaos that defines Twitter’s beloved stream. Twitter ad sales will grow because Twitter will grow. With recent and upcoming acquisitions, Twitter will make its platform more approachable by big brands and small businesses alike. It’s what’s next, meaning after Twitter earns mainstream awareness and understanding that I’m paying attention to.

Connect with me: Twitter | LinkedIn | Facebook | Google+ |Youtube | Instagram

Nicely written, Brian!

Along with so many other communications professionals

around the world, I have come to value your insights and perspectives that help

keep us one tweet ahead in our modern-information environment!

Regards, Ted

Thanks Ted!

Isn’t it ironic, Brian, that social is undermining the power of advertising, yet all four major platforms are valued purely on the advertising revenue they attract.

Where do you see the tipping point here – at some point marketers must surely move beyond advertising and revenues will fall, probably not just a little but catastrophically?

well said!!

Great point Peter! I think it’s the power of the channels that’s being affected. TV, newspaper and radio are being hit hard by online ad channels (specifically social media platforms) due to the high level of demographics/content advertising that advertisers can achieve in comparison to the traditional channels.

One of the major tipping points will be when the browser will be baked into television sets. Then watch the large TV networks scramble for advertising dollars. More fragmentation is coming…

Best

Supposedly, Twitter is doing $500M annually in topline. It’d be interesting to see their revenue breakdown.

What an ocean of data for brands to tap into @briansolis:disqus. Providing contextual information for brands to create the beautiful experience for the audiences is one of the major pillars of success for Twitter.

The cost for the public to stay connected are the ads….until a more beautiful experience comes along, Twitter has to stay innovative to keep ‘our’ attention. If not, it’ll be tweet you later 😉

Whatever happens I’m going to rush to buy stock like I did with Facebook!

I relish, cause I discovered exactly what I was taking a look for.

You’ve ended my four day long hunt! God Bless you man. Have a great day.

Bye

宣传片制作|企业宣传片|企业宣传片拍摄|企业宣传片制作|影视制作公司|宣传片拍摄哪家强视频制作公司|企业宣传片文案|宣传片 http://www.d2film.com 拍摄公司|宣传片制作公司|宣传片制作公司企业宣传片报价|影视制作价格|公司宣传片制作|企业视频制作|企业宣传片制作公司企业宣传片制作公司|公司宣传片拍摄|产品宣传片拍摄|企业宣传片策划|影视制作报价影视制作团队|影视制作哪家好|视频制作团队|视频制作费用|视频制作价格|宣传片拍摄报价单视频制作哪家拍的好|企业拍宣传片|大企业宣传片|企业宣传片怎么做|企业宣传片制作报价企业宣传片制作价格|企业宣传片拍摄公司|企业宣传片创意视频|企业宣传片制作哪家好5分钟宣传片一般多少钱|企业

求婚视频| http://www.5aivideo.com 婚礼视频|婚礼跟拍|婚礼微电影|婚礼现场视频|婚礼MV|婚礼摄影|婚礼摄像婚礼mv视频|婚礼视频制作|婚礼高清摄像|婚礼跟拍作品|婚礼跟拍价格|婚礼跟拍摄影婚礼跟拍录像|婚礼跟拍摄像师|婚礼跟拍多少钱|最感人的婚礼视频|婚礼视频mv短片制作婚礼摄影师|婚礼摄影跟拍价格|婚礼摄影一般多少钱|婚礼摄影师一场多少钱|豪华婚礼mv婚礼mv|婚礼花絮mv|婚礼视频mv短片|婚礼上播放的mv视频|最浪漫感人的婚礼视频结婚mv创意视频短片|婚礼创意mv婚礼上播放|婚礼摄像师|婚礼摄像价格|婚礼高清摄像婚礼摄像团队|婚礼摄像跟拍|婚礼摄影摄像哪个重要|婚礼微电影制作|婚礼微电影机构国外婚礼微电影|婚